The State Bank of India (SBI) has announced a special fixed deposit scheme exclusively for senior citizens, namely the SBI WeCare Deposit. This scheme is tailored for those aged 60 years and above, offering interest rates higher than those available in regular fixed deposits.

This scheme securitizes the financial support and provides a steady income, allowing senior citizens to invest comfortably for good returns that are risk-free and secure.

Why Choose SBI WeCare Deposit Scheme?

The SBI WeCare Deposit therefore stands as the senior citizen’s most preferred reliable scheme for investment. Retirees knowing that the bank is a government entity will have the assurance of security and trustworthiness, one certain to be highly considered when weighing investing options.

The Various Features of SBI WeCare Deposit

- Higher Interest Rate- Senior deposits earn 0.5 % more than ordinary FDs. Example. Say for an FD for normal deposits with interest of 6.50%, this scheme gives 7.00%, which, with returns assured in better times, will mean more income.

- Flexible Tenures- The investor can choose a period of 1 year to 10 years, and hence they may time their investments according to future cash flow requirements.

- Interest Payment Every Three Months- This scheme allows a quarterly payment of interest to those seeking to generate a regular income.

- Total Security- Being an SBI scheme, the deposits are 100% secure, while the DICGC covers the deposits with insurance to the extent of ₹5 lakh.

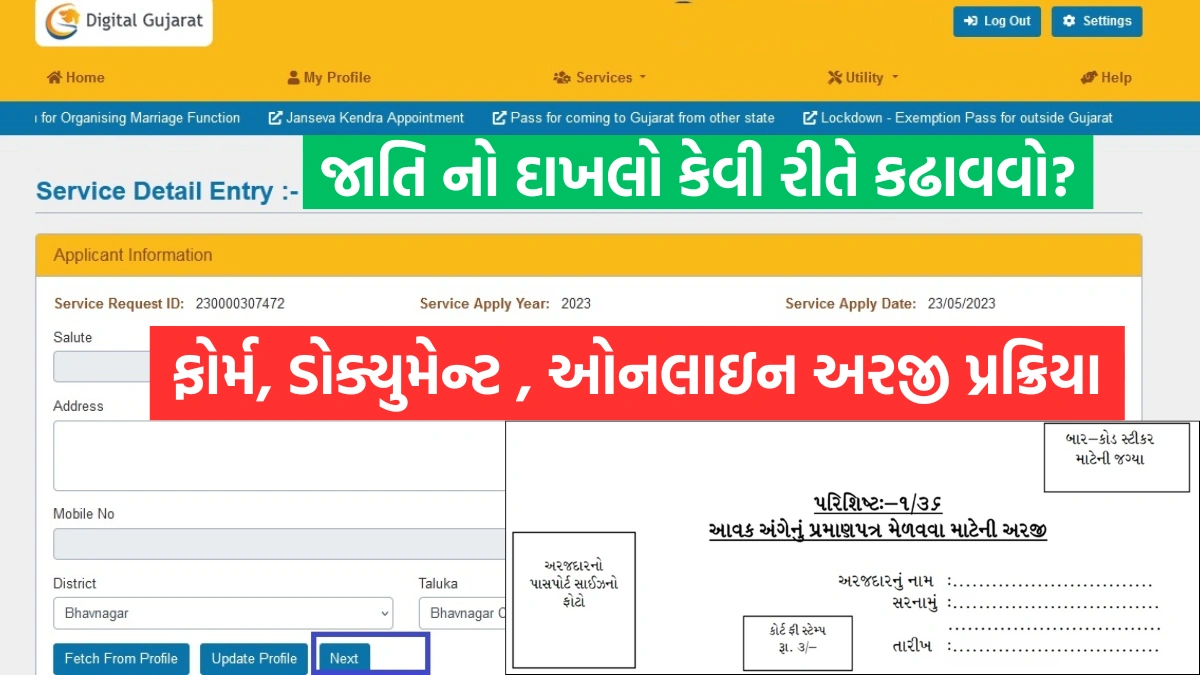

How to Invest in SBI WeCare Deposit?

Investing in this scheme is simple and hassle-free. Senior citizens can either:

- Visit their nearest SBI branch

- Apply online through SBI’s internet banking portal

Documents Required

- Age proof (such as a birth certificate or pension documents)

- Aadhaar Card or PAN Card

- Address proof (passport, utility bill, etc.)

Who Should Consider This Scheme?

The SBI WeCare Deposit is perfect for retirees who:

- Want a risk-free investment with guaranteed returns

- Prefer a government-backed scheme for maximum security

- Need a regular income source post-retirement