bob e mudra loan apply online 50 000 Now get a loan of up to Rs 5 lakh in 2 minutes! About Bank of Baroda

Bank of Baroda, founded in 1908, is one of the most trusted banks in India. The bank offers facilities such as home loans, car loans, business loans, gold loans and personal loans, thereby meeting the financial needs of millions of customers. bob 50 000 mudra loan kaise milega 2025

Bank of Baroda Personal Loan Documents Required

- Aadhaar Card (linked with mobile number)

- PAN Card

- Last 6 Months’ Bank Statements

- Salary Slips / Business Proof (if self-employed)

Why Choose Bank of Baroda Personal Loan?

- Lowest Interest Rates (11.40% – 18.75%)

Compared to other banks, Bank of Baroda offers affordable interest rates based on your CIBIL score and income. - Fast & Paperless Online Process

No more visiting banks! Apply online in minutes and get instant approval. - No Security or Guarantor Needed

This is an unsecured loan, meaning you don’t need to pledge any assets. - High Loan Amount (Up to ₹20 Lakhs)

Whether you need ₹50,000 or ₹20 lakhs, Bank of Baroda has you covered.

Bank of Baroda Personal Loan Eligibility Criteria

- Age: 21 to 65 years

- Minimum Income: ₹15,000/month (salaried/self-employed)

- CIBIL Score: 650+ (good credit history)

- Indian Resident

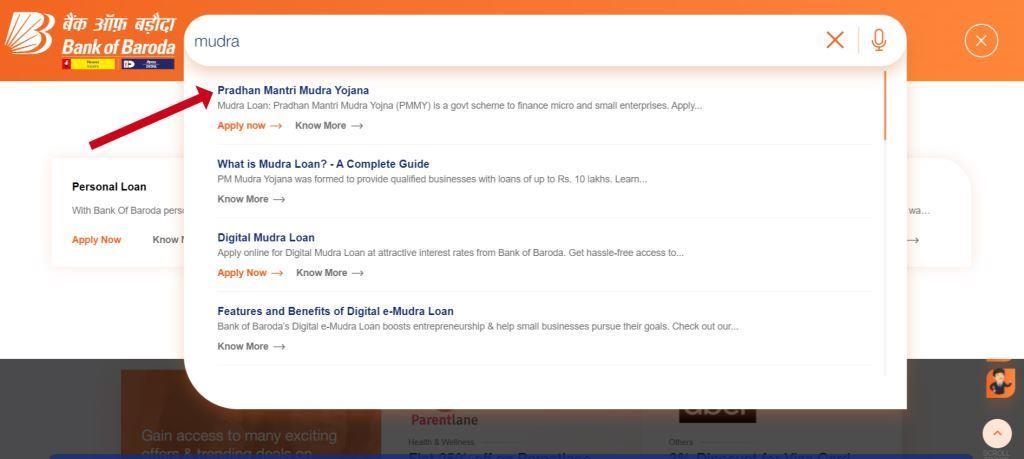

How to Apply Bank of Baroda Personal Loan (Step-by-Step Guide)

- Visit the Official Website Go to Bank of Baroda Personal Loan Page

- Log in via Net Banking Use your User ID & Password

- Select ‘Personal Loan’ Option Choose loan amount (₹50,000 to ₹20 lakhs)

- Select repayment tenure (3 months to 7 years)

- Upload Documents & Submit Scan and upload required documents

- Click “Submit”

- Get Instant Approval & Disbursal

- Bank verifies details Loan amount credited within 24-48 hours

note:We have only given information about loans. Whether you take a loan or not depends on you. We will not be responsible for any of the articles.

Bank of Baroda Personal Loan Frequently Asked Questions (FAQs)

Can I get a loan without a CIBIL score?

No, a minimum CIBIL score of 650 is required.

Is this loan available for self-employed individuals?

Yes! Salaried & self-employed both can apply.

How soon will I get a ₹50,000 loan?

If documents are correct, funds are transferred within 24 hours.

What is the maximum loan amount?

You can avail up to ₹20 lakhs based on eligibility.

Maam

Amul

I want to one lakh RS loan only

I want

50000

Samastipur state bihar

Samastipur state bihar pin 848503