The Indian government has created several welfare schemes to help its citizens get over the economic impacts of the COVID-19 pandemic. One of the most transformational programs is the PM Svanidhi Yojana, which aims to empower street vendors, the small traders, rickshaw-pullers, and low-end-tier entrepreneurs, giving them easy access to interest-free loans.

So, if you feel your small business requires some revival or is on the verge of starting, this scheme might just be that golden opportunity for you. This article will be telling you everything you need to know about the scheme-perks, eligibility, application details, and key documents-so you can comfortably apply for it.

What is PM Svanidhi Yojana?

The PM Svanidhi Yojana was launched by the Government of India to provide financial assistance from ₹10,000 to ₹50,000 to small vendors and entrepreneurs with the aim of helping them revive their businesses to be self-dependent, thereby contributing to the growth of the Indian economy.

What sets the scheme apart from bank loans is the low interest, cashback benefits on digital transactions, and flexible repayment options provided for the scheme that are instrumental in taking away several business concerns from the small business owners.

Who’s Eligible to Apply PM Svanidhi Yojana? (Eligibility Criteria)

This scheme is for street vendors and small-scale businesses in an urban environment. Here are eligible to apply:

- Street vendors possessing valid vending certificates or ID cards issued by an Urban Local Body (ULB).

- Vendors recognized in the government survey on street vendors, although not yet certified (these will be issued temporary certificates).

- New vendors after the survey, this requires a Letter of Recommendation (LoR) from ULB/TVC.

- Vendors in rural and peri-urban areas selling in the city limits (with ULB encouragement).

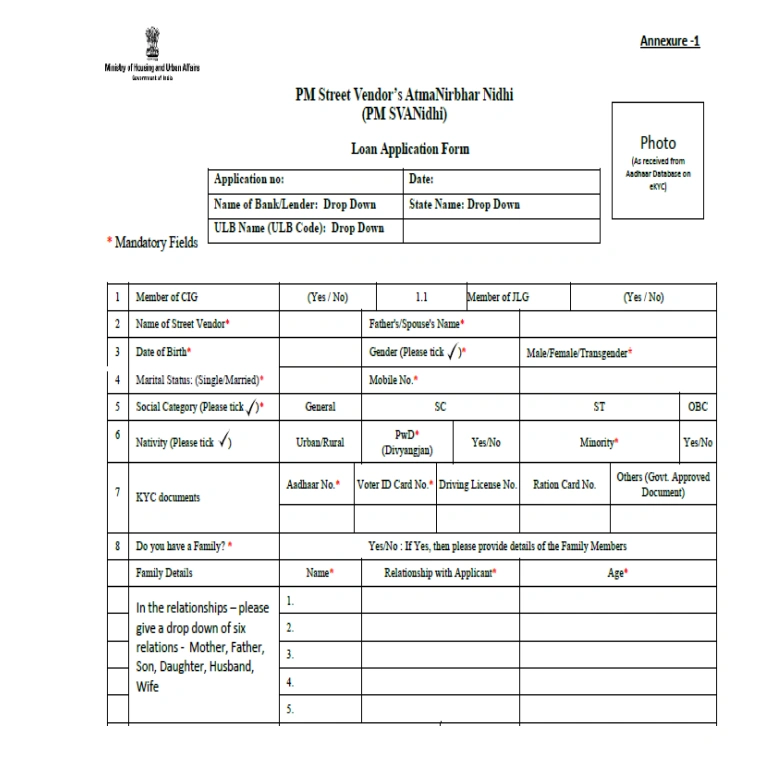

PM Svanidhi Yojana Documents Required

- Aadhaar Card (linked to mobile number)

- Proof of Business (vending license, ULB certificate, or LoR)

- PAN Card (for income verification)

- Bank Account Details (for loan disbursement)

- Address Proof (electricity bill, rental agreement, etc.)

- Passport-size Photo

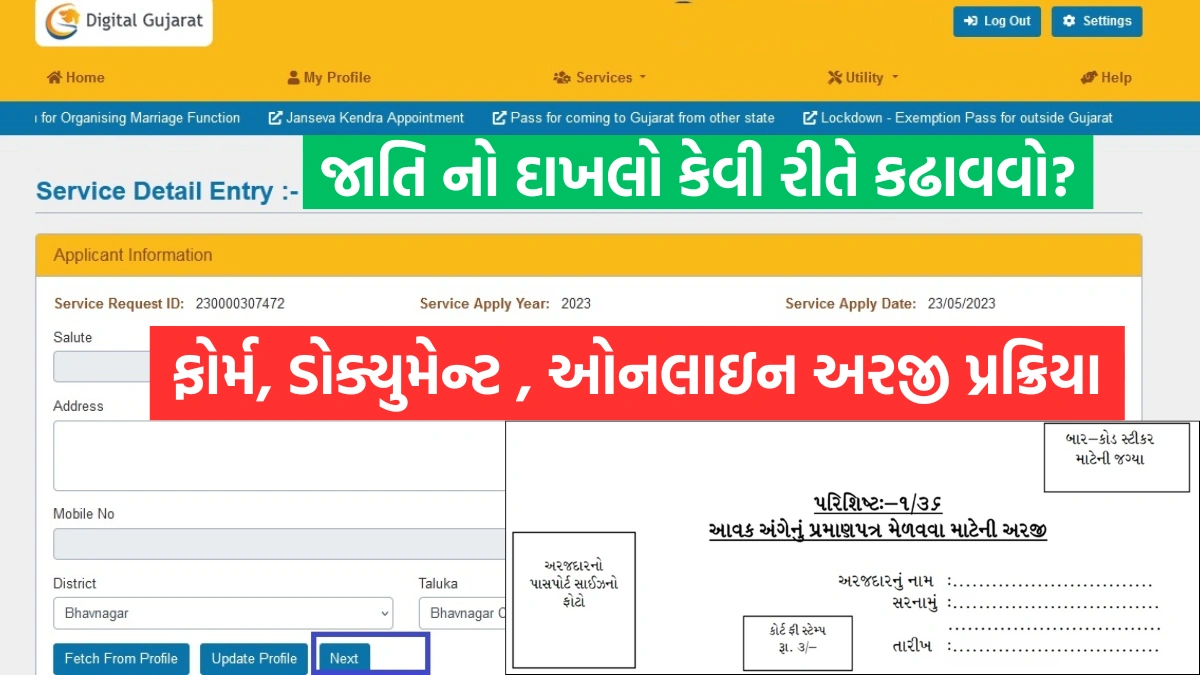

How to Apply Online for PM Svanidhi Yojana? (Step-by-Step Guide)

Getting a loan under this scheme is quick and hassle-free. Follow these steps:

- Visit the Official Website – https://pmsvanidhi.mohua.gov.in

- Click on “Apply Now” – Fill in your personal and business details.

- Upload Required Documents – Aadhaar, business proof, PAN, etc.

PM Svanidhi Yojana

- Review & Submit – Double-check all details before final submission.

- Track Application Status – Use the PM Svanidhi Mobile App for updates.

PM Svanidhi Mobile App – Your Loan Assistant

To make the process even smoother, the government has launched the PM Svanidhi Yojana App, where you can:

- Check eligibility

- Apply for a loan

- Track application status

- Access e-KYC services

- Get repayment reminders

Benefits of PM SVANidhi Yojana

- Quick Financial Support – Get ₹10,000 to restart your business.

- Flexible Repayment – Pay in easy monthly installments.

- No Penalty – No extra charges for delayed payments.

- Boosts Creditworthiness – Improves chances for future loans.

- Direct Subsidy Transfer – 7% interest subsidy credited quarterly.